Feeling stuck with your current loan? Refinancing is the perfect way out, whether it's high interest rates, overwhelming monthly payments, or a desire for better terms. But is it the right move for you?

Refinancing a loan can lead to lower payments, reduced interest rates, and even extra cash in your pocket. However, it's not always a guaranteed win. Refinancing can sometimes extend your debt, increase costs, or come with hidden fees. Before deciding, let's break down everything you need to know about refinancing—when it makes sense, when it doesn't, and how to do it correctly.

What Does It Mean To Refinance A Loan?

Refinancing means replacing your current loan with a new one—ideally with better terms. The new loan pays off the old one, and you start fresh with a different interest rate, repayment period, or loan structure.

People refinance all types of loans, including:

Mortgages

One of the most common refinancing options is to lower interest rates or adjust loan terms.

Auto Loans

Often refinanced to reduce monthly payments or secure a lower interest rate.

Student Loans

Refinancing can help lower payments, consolidate multiple loans, or switch from federal to private loans.

Personal Loans

Refinancing can provide better rates or allow you to borrow additional funds.

While refinancing can be a smart financial move, it’s not always the best choice for every borrower. Let’s explore the potential benefits and drawbacks.

Why Do People Refinance Their Loans?

There are several reasons why refinancing might be a good idea, depending on your financial situation and goals.

Lower Interest Rates

Interest rates fluctuate over time. If you took out a loan when rates were high, refinancing at a lower rate could save you thousands of dollars over the life of the loan.

Lower Monthly Payments

Extending your loan term through refinancing can reduce your monthly payments, making it easier to manage your budget. However, this may mean paying more interest in the long run.

Shorter Loan Term

Some borrowers refinance to pay off their loans faster. For example, switching from a 30-year mortgage to a 15-year term can help you save on interest, though your monthly payments may be higher.

Switching From A Variable To A Fixed Rate

If your current loan has a variable interest rate, refinancing to a fixed-rate loan can protect you from future rate hikes and provide more predictable payments.

Debt Consolidation

Refinancing can help you combine multiple loans into one, simplifying your finances and securing a lower interest rate. This is common with credit card debt, student loans, and personal loans.

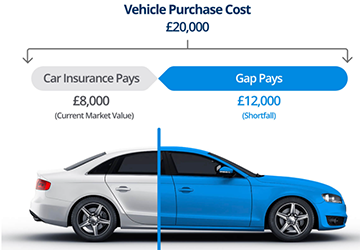

Cash-Out Refinancing

For homeowners, cash-out refinancing allows you to borrow against your home's equity and receive a lump sum. This can be used for home improvements, debt repayment, or other expenses.

When Refinancing Might Not Be The Best Choice

While refinancing has clear benefits, it’s not always the right move. Here are some scenarios where refinancing could do more harm than good.

High Closing Costs And Fees

Many loans come with refinancing fees, including closing costs, prepayment penalties, or application fees. Refinancing may not be worth it if these costs outweigh the potential savings.

Extending Your Debt For Too Long

Lower monthly payments may sound great, but if refinancing extends your loan term significantly, you could pay more in interest over time.

Lower Credit Score

Your credit score plays a significant role in refinancing eligibility. You may not qualify for better terms if your score has dropped since you took out the original loan.

You Plan To Move Or Pay Off The Loan Soon

If you’re refinancing a mortgage or auto loan but plan to sell your home or car soon, the savings from refinancing might not be worth the hassle and upfront costs.

Losing Federal Benefits On Student Loans

Refinancing federal student loans with a private lender means losing access to government benefits like income-driven repayment plans, deferment, or loan forgiveness programs.

How To Refinance A Loan The Right Way

If refinancing seems like a good fit for your situation, here’s how to do it wisely:

Check Your Credit Score

A higher credit score can help you secure better refinancing terms. If your score is low, consider improving it before applying.

Shop Around For The Best Rates

Different lenders offer different rates and terms. Compare multiple offers from banks, credit unions, and online lenders to find the best deal.

Calculate The True Cost

Use a loan refinancing calculator to determine how much you'll save (or lose) on a new loan—factor in fees, interest rates, and loan terms.

Read The Fine Print

Watch out for hidden fees, prepayment penalties, or conditions that could make refinancing less beneficial than it appears.

Consider Your Long-Term Goals

Think about how refinancing fits into your overall financial plan. Will it help you reach your goals faster or provide temporary relief?

Common Mistakes To Avoid When Refinancing

Refinancing can be a smart financial move, but only if done correctly. Many borrowers make critical mistakes that cost them more than they save. Here are some common pitfalls to watch out for:

Not Checking Your Credit Score First

Lenders offer the best refinancing rates to borrowers with strong credit. If your score has dropped since taking out the original loan, you may not qualify for a better deal. Before applying, check your credit score and take steps to improve it if necessary.

Ignoring The Total Loan Cost

Many focus only on securing a lower monthly payment without considering the long-term cost. If you extend your loan term significantly, you could pay more interest over time—even if your new interest rate is lower.

Overlooking Fees And Penalties

Refinancing often involves fees such as closing costs, origination fees, or prepayment penalties. Failing to account for these expenses can reduce your savings, making refinancing less beneficial than it initially appears.

Not Comparing Multiple Lenders

Sticking with your current lender might seem convenient, but it’s not always the best financial choice. Rates and terms vary widely between lenders, so shopping around can help you secure a better deal.

Refinancing Too Often

Some borrowers refinance multiple times, hoping to keep lowering their interest rates. However, each refinancing comes with costs, and repeatedly resetting your loan term can extend your debt indefinitely.

So, Is Refinancing Right For You?

Refinancing can be a great financial tool, helping you save money, lower payments, or simplify debt. However, it's not always the right choice—significantly if it extends your debt, comes with high fees, or negatively impacts your financial future.

Before refinancing, take the time to compare options, crunch the numbers, and ensure that the benefits outweigh the costs. A well-planned refinancing decision can set you on the path to financial freedom, while a rushed one can lead to unexpected pitfalls.