Gap insurance emerges as a quintessential bulwark, fortifying you against pecuniary vicissitudes when your vehicle succumbs to total loss or is feloniously absconded. This indispensable coverage serves as a financial conduit, ameliorating the discrepancy between your vehicle's intrinsic valuation and the quantum of debt encumbered through your financing or leasing accord. Our exposition will elucidate the importance of gap insurance coverage, proffer an intricate guide to navigating vehicle gap insurance, and explain the modus operandi of gap insurance in layperson's terms.

Pivotal Significance of Gap Insurance Coverage

● Monetary Fortification: Gap insurance stands sentinel, safeguarding against fiscal dissonances by reconciling the chasm between the vehicle's prevailing market esteem and the residual financial obligations.

● Equanimity: The guarantee of comprehensive coverage in the wake of total vehicular loss engenders a serene assurance, invaluable for those deeply invested in their automotive assets.

● Economic Prudence: When weighed against the spectre of potential monetary forfeit sans coverage, gap insurance manifests as a reasonable investment, effortlessly dovetailing with your primary automotive insurance schema.

All-out About Vehicle Gap Insurance

● Eligibility Demarcations: The applicability of gap insurance is circumscribed and generally availed for contemporary vehicular models, conditional upon the endorsement of comprehensive and collision insurance.

● Procurement Pathways for Gap Insurance: This specialized insurance variant can be acquired through your incumbent automotive insurance provider, the dealership facilitating your vehicle purchase, or dedicated entities offering gap insurance.

Functional Paradigm of Gap Insurance

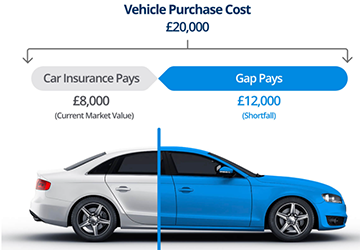

Confronted with a scenario wherein your vehicle is adjudged a total loss, standard automotive insurance policies extend compensation solely for the vehicle's current market valuation. When the outstanding financial liability overshadows this valuation, gap insurance intervenes to rectify the economic imbalance.

Salient Considerations Before Gap Insurance Election

A thorough introspection of your fiscal landscape and the intricacies of your vehicle financing or leasing terms is imperative in deciding upon gap insurance. Key contemplations encompass:

● Depreciation Velocity: Vehicles depreciate accelerated, rendering gap insurance an essential safeguard in the nascent stages of ownership.

● Amortization Trajectory: Prolonged financing durations amplify the likelihood of your financial liability outstripping the vehicle's valuation, bolstering the case for gap insurance.

● Initial Fiscal Outlay: Modest down payments escalate the financed quotient of the vehicle's worth, potentially augmenting the fiscal discrepancy addressed by gap insurance.

Real-Life Scenarios Where Gap Insurance Is Beneficial

1. Catastrophic Loss Scenarios: In the dire eventuality of an accident precipitating a total vehicular loss, gap insurance emerges as your fiscal shield, bridging the financial rift.

2. Larceny Incidents: In the event of your vehicle's theft and subsequent non-recovery, gap insurance plays a pivotal role in harmonizing the financial equation between the insurance remuneration and your lingering financial commitment.

In-Depth Exploration of Gap Insurance's Effectiveness

Harmonizing with Depreciation Trajectories

● Proactive Fiscal Strategy: Acknowledging the swift value decline of automobiles in their early years, the reasonable acquisition of gap insurance is paramount in countering unexpected financial burdens emanating from sudden asset depreciation.

The Extensive Safeguarding Measures

● Beyond the Usual Risks: Traditionally linked with addressing financial disparities following accidents or vehicle theft, gap insurance equally plays a pivotal role in safeguarding against financial losses attributed to natural calamities, malicious damage, and other unpredicted incidents, broadening the scope of risk reduction.

Dissecting Gap Insurance's Subtleties

The Integration and Evolution of Policies

● Effortless Incorporation: Comprehending the mechanism of integrating gap insurance with prevailing auto insurance policies aids in circumventing potential overlaps or deficiencies in coverage, fostering a cohesive protection scheme.

● Adaptable Policy Dynamics: With fluctuating fiscal situations, the capability to modify, enhance, or conclude gap insurance coverage is crucial for sustaining financial agility and security.

Maximizing Gap Insurance Benefits

Applying Gap Insurance to Leased Automobiles

● Crucial for Lease Holders: For parties engaging in vehicle leasing, the significance of gap insurance escalates, ensuring fiscal safeguarding against the stringent stipulations of lease agreements regarding vehicle return and condition criteria.

Navigating Choices for Vehicles Prone to Swift Depreciation

● Discerning Insurance Selection: Automobiles notorious for their rapid decline in value necessitate a deliberate approach towards gap insurance, spotlighting the imperative for customized evaluations to ascertain the coverage's relevance and temporal scope.

The Economic Ramifications of Gap Insurance

Influences on Financing Terms

● Interest Rate Implications: Incorporating gap insurance subtly alters the financial landscape of an automobile loan, especially within dealership financing scenarios, compelling a meticulous analysis of financing terms and implications.

Enhancing Insurance Premium Efficacy

● In-depth Financial Analysis: A comprehensive evaluation of gap insurance premiums regarding potential financial risk exposure facilitates informed decision-making regarding the coverage's duration and breadth.

Surpassing Traditional Gap Insurance Perspectives

Pioneering Protection Alternatives

● Advancements in Insurance Offerings: The continual evolution within the automotive and insurance sectors necessitates awareness of novel and superior insurance solutions that parallel or exceed the protections offered by conventional gap insurance, furnishing additional layers of financial security for vehicle proprietors.

The Customizable Policy Solutions

● Bespoke Coverage Options: Investigating the avenues for policy personalization unveils potential adjustments in coverage levels, thereby fine-tuning protection and costs to align with individual risk profiles and financial requirements.

Enhancing Consumer Education on Gap Insurance

Empowering Consumers through Knowledge

● Comprehensive Educational Initiatives: Developing initiatives to educate vehicle owners about the nuances, benefits, and strategic use of gap insurance can empower consumers to make informed decisions that align with their financial and automotive goals.

Gap Insurance and Financial Wellness

● Integrating Coverage with Financial Planning: Encouraging the inclusion of gap insurance in personal financial planning discussions can underscore its importance in maintaining financial wellness in the face of potential automotive losses.

Conclusion

Gap insurance coverage is an indispensable fortress of financial defence for many automobile proprietors. By assimilating the knowledge of how gap insurance operates and employing this vehicle gap insurance guide, you can navigate the decision-making labyrinth with enhanced clarity and confidence. At its core, gap insurance is purposed to inoculate you against the financial strain attendant to the untimely demise of your vehicle, establishing itself as a wise choice for discerning drivers.