Navigating the labyrinthine health insurance domain often resembles a journey through an intricate maze. With abundant options and esoteric jargon, attaining a fundamental comprehension is imperative. This exposition seeks to elucidate the quintessence of health insurance, dissect the myriad types of health insurance plans, and demystify the concept of health insurance itself. Arming oneself with this erudition can facilitate adjudicating an informed verdict regarding one's healthcare provisions.

Deciphering Health Insurance: The Elemental Principles

In its most fundamental guise, health insurance functions as a bulwark, proffering financial indemnification for medical and surgical expenditures borne by the insured. Yet it transcends the mere role of a fiscal safeguard—it is an indispensable instrument for safeguarding health and welfare.

● Imperative: Health insurance acts as a bastion against the vicissitudes of unforeseen, prohibitive medical outlays and assures unfettered access to healthcare when it becomes exigent.

● Modus Operandi: By opting for a plan and agreeing to a monthly premium, your health insurance scheme may defray a portion of your healthcare disbursements.

An in-depth understanding of health insurance is pivotal in appreciating its benefits. Health insurance extends beyond mere ailment coverage to include preventative measures aimed at sustaining health.

Cataloging Suitable Health Insurance Plans

The quest for an apt health insurance plan is intrinsically personal, with no one-size-fits-all solution. Herein lies a brief exposition of the predominant types:

HMOs

● Propensity for primary care: Advocates the selection of a primary care physician to oversee and orchestrate your healthcare regimen.

● Necessity for specialist referrals: Your primary care physician orchestrates your care and endorses referrals for specialist consultations.

● Benefits: Diminished out-of-pocket expenditures and comprehensive coverage.

PPOs:

● Adaptability in selecting physicians: Affords the autonomy to engage with any healthcare provider, irrespective of network affiliation.

● Absence of referral prerequisites: Facilitates direct engagements with specialists sans primary care physician intercession.

● Benefits: Augmented flexibility bestows greater sovereignty over healthcare determinations.

EPOs (Exclusive Provider Organizations) and POS (Point of Service) Plans

● The conflation of modalities: Merges aspects of HMOs and PPOs, proffering options.

● Equilibrium between cost and care flexibility: These plans may offer a reasonable balance between financial implications and the latitude to consult specialists.

Insight into the types of health insurance plans is indispensable for pinpointing the plan that best aligns with your healthcare necessities and fiscal disposition.

Expounding on Health Insurance: Beyond the Superficial

Grasping what health insurance signifies, in theory, diverges from understanding its pragmatic impact on your existence. It encapsulates:

● Preventive measures: Regular checkups, immunizations, and screenings are designed to prevent disease onset.

● The tranquillity of mind: Alleviating apprehensions regarding healthcare expenses can positively influence overall well-being.

● Accessibility to healthcare services: Encompasses a gamut from emergency interventions to prescription drugs and mental health support.

Health insurance constitutes a pivotal element of your physical and fiscal health. It epitomizes not merely coverage but accessibility, serenity, and, fundamentally, your health.

Enlightened Decision-Making

Armed with an intricate understanding of health insurance, familiarity with the types of health insurance plans, and a profound comprehension of health insurance, you will be better equipped to forge enlightened decisions. Consider your healthcare requisites, budgetary constraints, and the premium you place on flexibility versus cost when selecting a plan.

Assessing the Healthcare Coverage Terrain

Selecting a health insurance plan demands a meticulous evaluation of one's personal health requisites and financial capacity. This segment seeks to broaden the dialogue by illuminating critical factors and burgeoning trends within the health insurance domain that might sway one's decision-making paradigm.

Tactical Consideration of Coverage Alternatives

Many subtle elements merit consideration when charting the parameters for an ideal health insurance plan. It is essential to scrutinize the coverage provided, reflecting on your present health scenario and anticipated future health difficulties. Points for contemplation include:

● Coverage Breadth: Assess the plan's all-encompassing nature, spanning preventive measures, hospital care, ambulatory services, and pharmacological prescriptions.

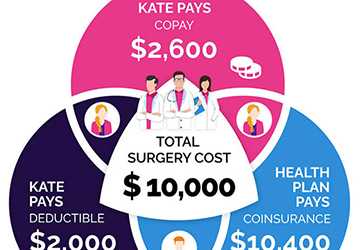

● Deductibles vs. Out-of-Pocket Expenditures: Grasping the equilibrium between regular premiums and incidental expenses is paramount. Typically, more affordable premiums correlate with elevated deductibles, which could influence your economic strategy.

Navigating Health Insurance in the Era of Digitization

The onset of digital innovation has markedly redefined the health insurance landscape, ushering in novel avenues and instruments for adept healthcare management.

● Telehealth Services: A significant number of health insurance plans now integrate telehealth provisions, offering distal engagement with medical professionals. This emerges as a pragmatic and cost-efficient alternative.

● Digital Health Management Implements: Applications and digital platforms enable you to document your health history, orchestrate appointments, and even liaise with your health care providers via the web.

Lifestyle and Health Insurance Synergy

A frequently underestimated aspect of selecting a health insurance plan is the unity between an individual's lifestyle and the plan's perks. For example:

● Wellness Incentives: Certain schemes incentivize salubrious habits, offering reductions for fitness club memberships or wellness initiatives aimed at smoking cessation or weight management.

● Chronic Condition Oversight Programs: For individuals navigating chronic ailments, some schemes proffer bespoke programs designed to aid in the continual care and management of medications.

Fortifying Your Health Coverage for the Future

With the continuous evolution of the healthcare landscape, your strategy in choosing health insurance ought to adapt correspondingly. Remaining abreast of healthcare legislation alterations, medical treatment breakthroughs, and health insurance policy modifications is crucial.

● Legislative Changes and Statutes: It’s imperative to stay informed about the impact of both federal and state legislation on health insurance benefits and costs.

● Medical Care Innovations: The advent of novel treatments and technological advancements could significantly alter your healthcare requirements and choices in the foreseeable future.

Conclusion

The expedition through the health insurance landscape can be manageable. With a rudimentary understanding of health insurance and insights into the types of health insurance plans, identifying a scheme that resonates with your prerequisites and economic blueprint becomes feasible. Remember that health insurance transcends a mere contractual obligation—it embodies an essential facet of your comprehensive healthcare strategy.